Business Insurance in and around Southbury

Get your Southbury business covered, right here!

No funny business here

Help Protect Your Business With State Farm.

Small business owners like you wear a lot of hats. From marketing guru to inventory manager, you do as much as possible each day to make your business a success. Are you a florist, a piano tuner or an optician? Do you own a bicycle shop, a vet hospital or a clothing store? Whatever you do, State Farm may have small business insurance to cover it.

Get your Southbury business covered, right here!

No funny business here

Cover Your Business Assets

Your business is unique and faces a wide array of challenges. Whether you are growing a clock shop or a pottery shop, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your business type, you may need more than just business property insurance. State Farm Agent Matthew J. Bub can help with extra liability coverage as well as employment practices liability insurance.

As a small business owner as well, agent Matthew J. Bub understands that there is a lot on your plate. Get in touch with Matthew J. Bub today to discuss your options.

Simple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

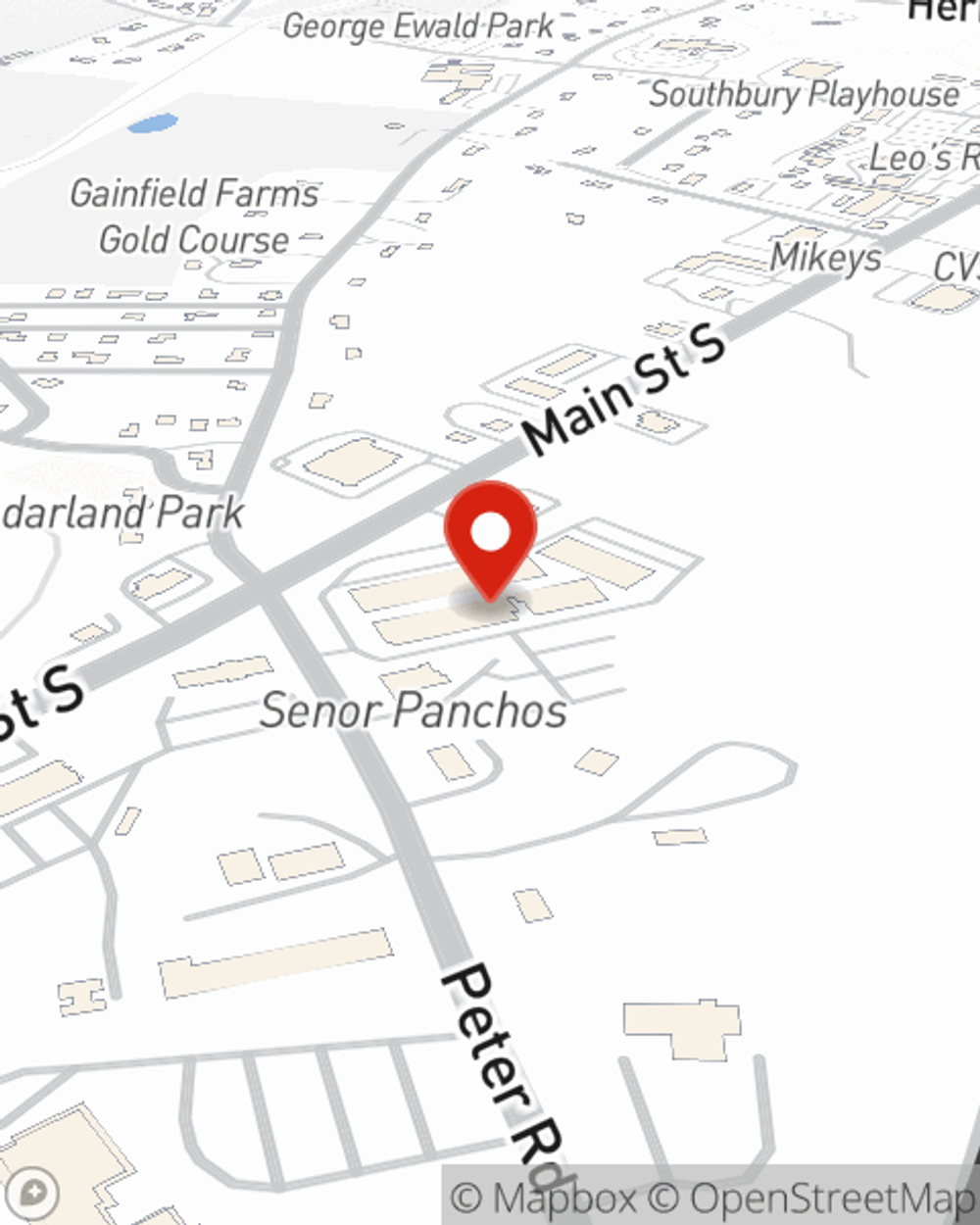

Matthew J. Bub

State Farm® Insurance AgentSimple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.